Simple Finances® App

Allianz did a study and found that for 61% of the participants, their number one fear is outliving their money. In fact, the study showed more people are afraid of outliving their money than death!

How bad is it? According to David McKnight in the book, “The Power of Zero,”(Acanthus Publishing, 2014) it is a real problem. McKnight says that for people reaching age 65, people are either dead or:

- 50% have no money or assets

- 75% have less than $28,000 in assets

- 90% have less than $140,000 in assets

Besides the lack of assets, there are other events that may ensure you will outlive your money and must downsize. They include:

- Not enough guaranteed income

- Sequence of Return Risks

- Health and Long-Term Care events

- Recessions and Market Crashes

- Inflation and Taxes

Television and some Financial Advisors want you to think that all you need is a certain amount of money and you’ll be all set in retirement. We’ve all seen the commercials where clients are carrying their “Number” around. They looked something like these:

If It Were Only That Simple!

The problem with using a “number” for retirement is the assumption nothing adverse will ever happen. A number assumes no one is going to die prematurely or face a major health event, will never over-spend, or experience another recession or market crash. Without addressing these issues, you’ll never know what your real number is.

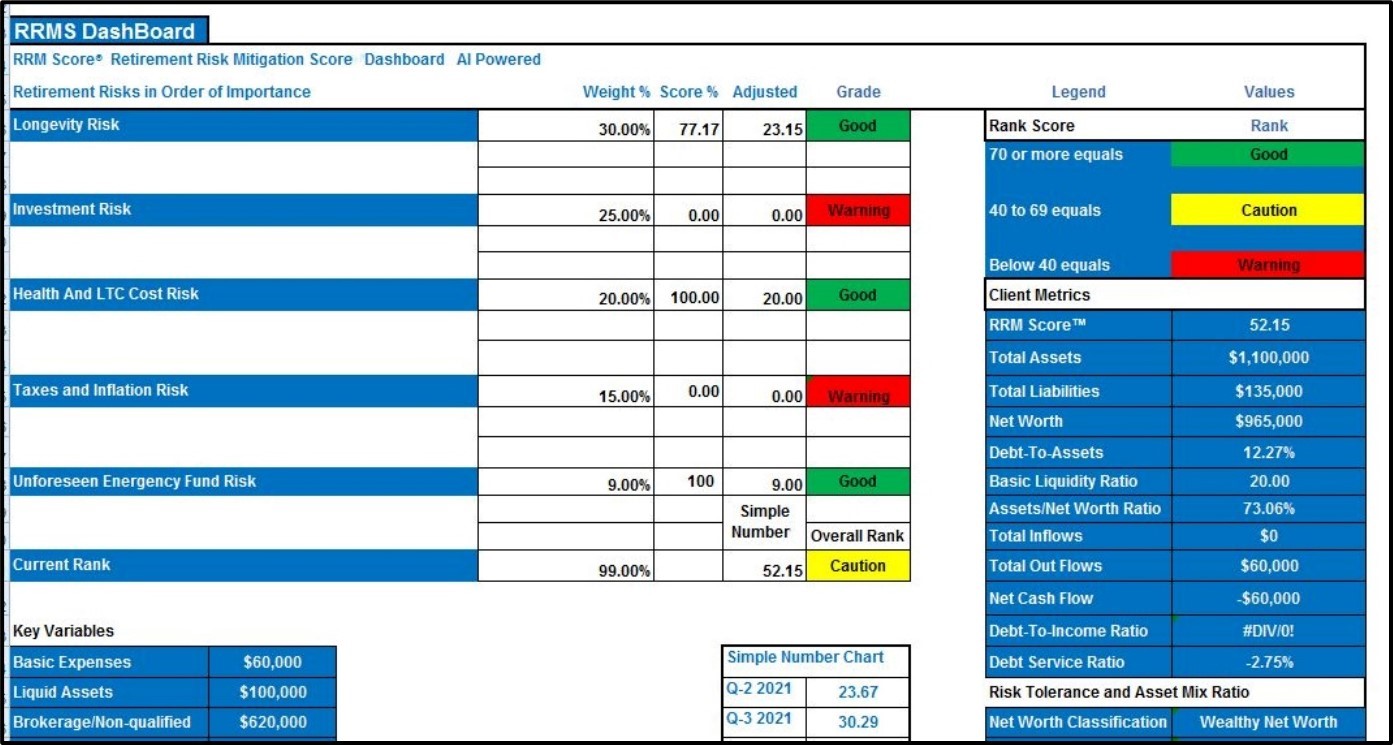

And while you need a financial goal to aim for, it is important to include all possible risks in your retirement plan. And Simple Finances® includes the most common risks among retirees. Here is a hypothetical example of a couple, David and Michelle, who have a net worth of $965,000. Their liabilities are low at $135,000. From the example below, it seems like they would easily be able to retire comfortably. When we put them in the Simple Finances® App, we see they have a probability of 52.15% of not outliving their money in retirement. Cautiously risky as shown.

Simple Finances® Before

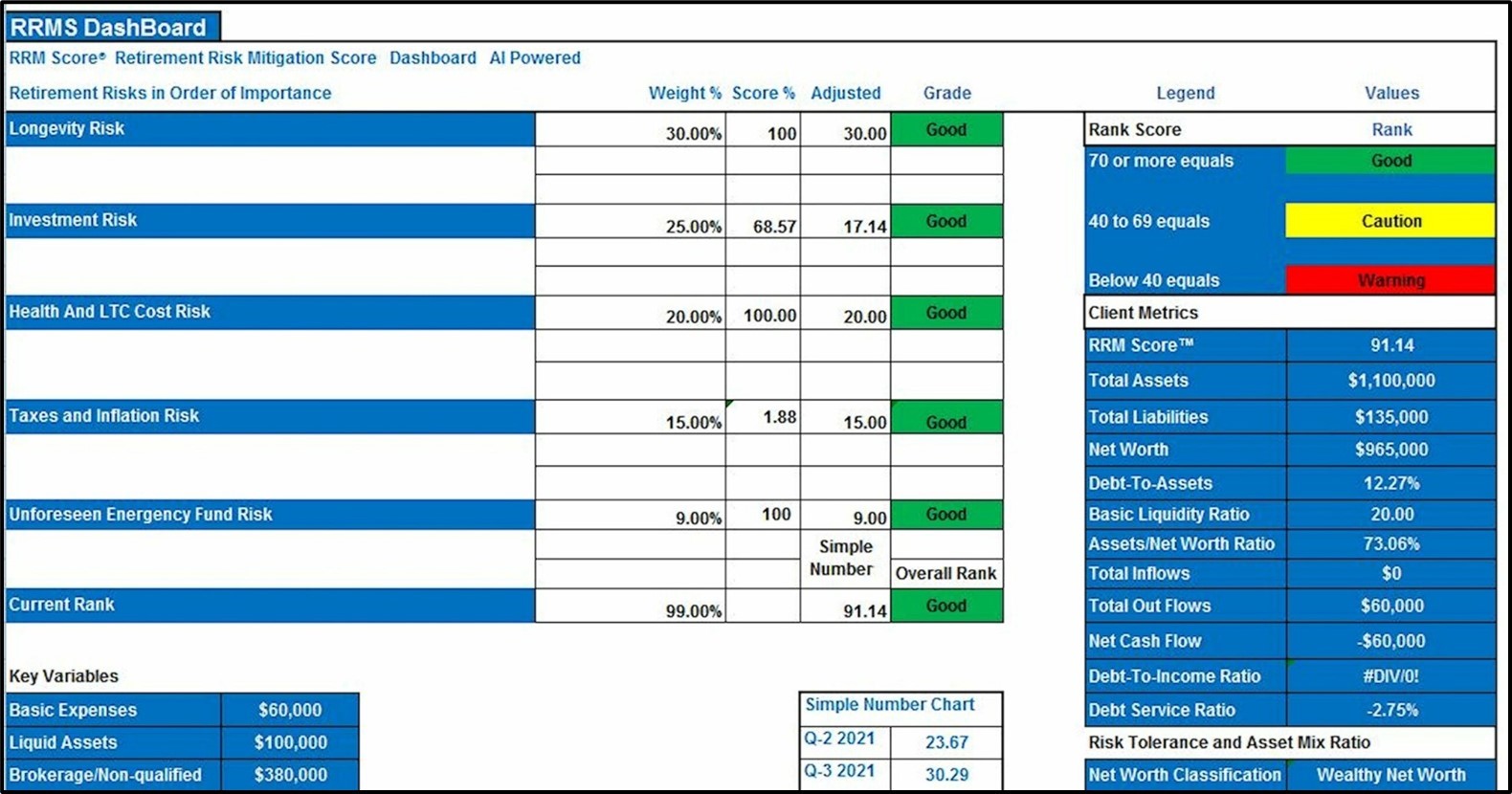

Simple Finances® After

Working with their Financial Advisor, David and Michelle, used the Simple Finances® Application to pinpoint their risks and make changes to their plan. They used the same assets as in the before scenario but by following the recommendations of the Simple Finances® Application, they increased their probability of not outliving their money to 91.14%, moving them into the green risk zone! They have reduced their risk of outliving their money from 47.85% (100%-52.15%) to only 8.86% (100%-91.14%). They cut their risk by 81%!

The Simple Finances® Application suggests changes to your retirement plan using the same assets arranged a little differently with the goal of getting you better results.

When you use the Simple Finances® App, you will create a retirement solution specific for your needs. You will know you’ve taken a big step to help make sure you don’t outlive your money or need to downsize your standard of living.

When you work with us, we update the Simple Finances® app and touch base with you quarterly to make sure everything is staying on track to meet your retirement goals.

Contact us today at 219-650-4050 or by completing this form to try the Simple Finances® App.

Upon clicking these links, the content you are going to is not controlled, reviewed or approved by, and is not the responsibility of, the website that you are leaving.